HARRISBURG, Pennsylvania — The Pennsylvania state Senate on Wednesday passed a package of legislation inspired by the Catholic Church scandals to relax criminal and civil statutes of limitations on sexual abuse crimes. Here is a look at the bills:

Criminal prosecution

There would be no statute of limitation on the criminal prosecution of major child sexual abuse crimes. Under current law, criminal prosecution is limited to a victim’s 50th birthday.

Authorities would have up to 20 years to file charges in sexual abuse cases where young adults 18-23 years old are the victim. Current law gives authorities up to 12 years to file charges in sexual abuse cases where the victim is over 17 years old.

Civil Lawsuits

Victims of child sexual abuse would have more time to file civil lawsuits against their abuser or an institution that may have covered it up. Under current law, a victim of child sexual abuse has until their 30th birthday to sue. The bill raises that to their 55th birthday, although that provision applies to future incidents of abuse.

Young adults 18-23 years old would have until they turn 30 to sue. Current law gives them two years to sue.

State laws aside, the Senate also began the multi-year process of seeking to amend the Pennsylvania Constitution to allow a two-year window for lawsuits to be filed by now-adult victims of child sexual abuse who are barred from suing by existing or previous statutes of limitation.

Sovereign immunity

Governmental institutions, such as public schools, would lose immunity from civil lawsuits for child sexual abuse if the person suing was harmed by the negligence of the institution.

Nondisclosure agreements

Nondisclosure contracts or agreements would be unenforceable if they attempt to impair, prohibit or suppress the disclosure of information about a claim of childhood sexual abuse to law enforcement.

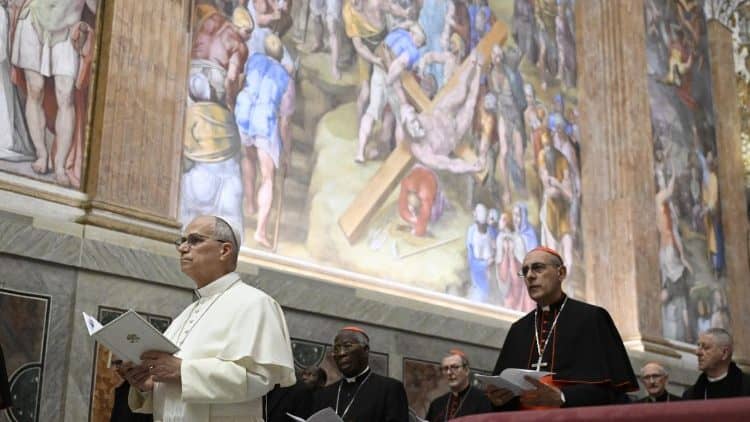

Crux is dedicated to smart, wired and independent reporting on the Vatican and worldwide Catholic Church. That kind of reporting doesn’t come cheap, and we need your support. You can help Crux by giving a small amount monthly, or with a onetime gift. Please remember, Crux is a for-profit organization, so contributions are not tax-deductible.