ROME – When it comes to Vatican finances, for decades there’s been a widely shared informal premise – or, possibly, just a prejudice – which held that anyone serious about reform would have to begin by breaking the Italian monopoly over the purse strings.

Of the last five popes, four tried to show they were in earnest by relying on non-Italians, and the one who didn’t, John Paul I, only reigned 33 days.

Back in 1967, when St. Paul VI created the Prefecture for Economic Affairs to try to inject rationality into Vatican money management, he named an Italian as its first prefect for political reasons, but as its first secretary – meaning the guy who actually did the work – he tapped an American of German ancestry, then-Father Raymond Philip Etteldorf from Iowa.

Later, when St. John Paul II wanted to clean things up, he turned to another American – Cardinal Edmund Szoka of Detroit, who had Polish roots and who led the Prefecture for Economic Affairs from 1990 to 1997.

When Pope emeritus Benedict XVI wanted a “purification” at the Institute for the Works of Religion, the so-called “Vatican bank,” he turned to a fellow German, Ernst von Freyberg, who brought in a legion of German consultants. When Benedict decided to create an anti-money laundering agency, he entrusted the project to Swiss lawyer René Brülhart.

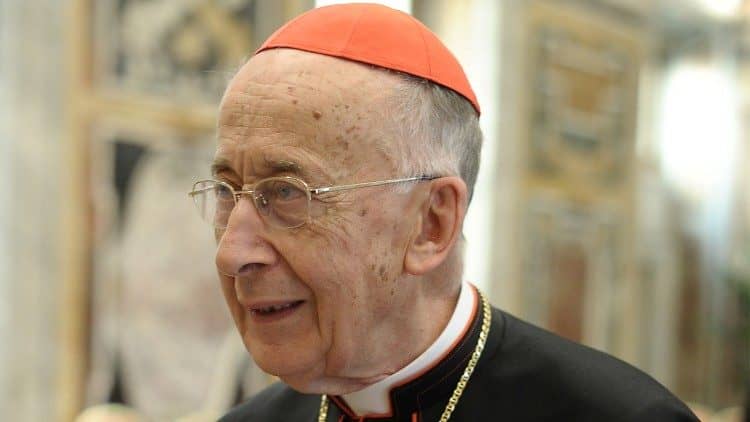

So it began too under Pope Francis, who initially tapped Australian Cardinal George Pell as the first Secretary for the Economy and German Cardinal Reinhard Marx as the head of his new Council for the Economy. Pell brought in an army of external consultants, mostly Anglo-Saxon and German.

Underlying all this is the unstated but almost axiomatic belief that the root of the Vatican’s financial problems lies in mimicking notoriously shady and nepotistic Italian business practices. By inference, the idea is that if you’ve got an Italian problem, you need non-Italians to take over.

In Francis’s new “Reform 2.0,” which has come into focus over the last four months or so, the assumption is almost exactly the opposite: If you have an Italian problem, then you need your own Italians to fix it.

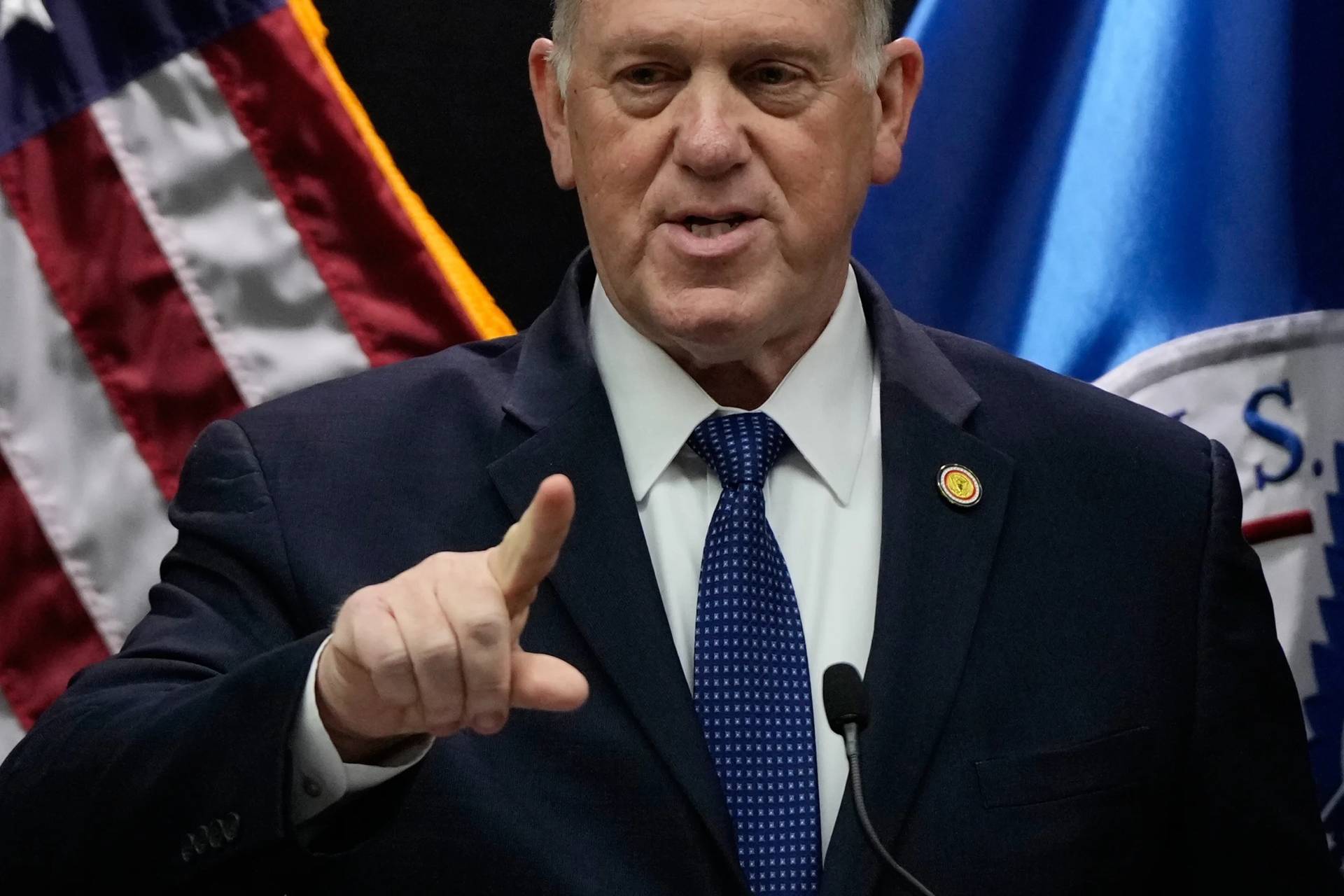

The thought comes to mind in light of the release on Friday of the annual report of the Financial Information Authority (AIF), the anti-money laundering unit created under Benedict. It was presented by the new president, Carmelo Barbagallo, a longtime official of the Bank of Italy named by Francis last November. Barbagallo’s deputy, tapped by Francis on April 15, is Giuseppe Schlitzer, another former Bank of Italy official, which means both top spots are held by Italians.

Though there were no thunderclaps, the report did show that AIF signaled 15 suspect transactions to the Vatican’s Promoter of Justice in the past year, most involving foreign entities and transactions in foreign jurisdictions.

Among other things, the report touts the fact that AIF’s suspension last November from the Egmont Group, the global umbrella group of financial intelligence units, was short-lived. It resulted from a Vatican probe of a $380 million London land deal, and it raised questions about whether AIF’s confidentiality agreements with other intelligence units had been breached by Vatican investigators. A deal inked between AIF and the Promoter of Justice addressed those concerns, and AIF was readmitted to the club.

More broadly, there are today nine departments or bodies in the Vatican with influence over financial operations:

- The Council for the Economy

- The Secretariat for the Economy

- The General Auditor

- The Institute for the Works of Religion (“Vatican bank”)

- The Financial Information Authority

- The Administration of the Patrimony of the Apostolic See (APSA)

- The Government of the Vatican City State

- The Secretariat of State

- The Promoter of Justice, responsible for prosecuting financial crimes

If we consider the top two positions at each body, that’s a grand total of 18 officials. As of today, 12 of these 18 key positions are held by Italians. Interestingly, there are only two Anglo-Saxons or Germans, and they’re both at the Council for the Economy, arguably the least impactful of all these bodies.

If we were to strike the council from the list we’d arrive at 16 positions with 12 Italians. Notably, only one of the remaining four, Jean-Baptiste de Franssu of the Vatican bank, is a native speaker of a language other than Spanish or Italian, the only two languages in which Francis is truly comfortable.

How to explain this apparent re-Italianization of the reform?

One way to think about it is this: Francis knew in 2013 he was elected on a mandate in part to clean up Vatican finances, and, at the beginning, he did what everyone before him had done, which is to bring in non-Italians. Yet he wasn’t at home in their worlds, so he ended up not knowing whom he could trust and, more or less, hit the “pause” button.

However, the double whammy of fresh scandal and ballooning deficits have compelled him to take up financial reform in earnest again, and he’s decided not to make the same mistake twice. This time, he’s opted to go with people he can vet personally and with whom he can communicate without filters.

To date, the early chapters of this “Reform 2.0” have drawn fairly good reviews, especially a new law on procurement aimed at eliminating conflicts of interest and rationalizing contracts. It’s too early to say how it will play out, and it’s worth remembering that Church history is replete with attempted reforms which seemed promising at the beginning but which, sooner or later, were capsized by inertia and business as usual.

Still, there is a sort of poetic justice to the pope’s new plan: If it’s true that Italians got the Vatican into this mess, perhaps it’s only apt it would be other Italians, serving a pope whose own family hails from the Italian Piedmont, to get it out.

Follow John Allen on Twitter at @JohnLAllenJr.