ROME – A remarkable report in a leading Italian newspaper Tuesday indicated that while he was an investment manager working in the Vatican’s Secretary of State, Italian layman Fabrizio Tirabassi, also had a contract with Swiss banking giant UBS paying him a 0.5 percent commission on every Vatican deposit, and also for deposits by new clients recruited by Tirabassi.

According to the report in Corriere della Sera, Italy’s most respected daily newspaper, the deal dated to 2004 and remained in place until Tirabassi was suspended from his Vatican post in 2019 amid investigations of the unfolding London property scandal.

An account in Tirabassi’s name was found by investigators at a USB bank in Lugano, Switzerland, according to the report, which contained $1.2 million, despite the fact that Tirabassi’s Vatican salary was around $3,000 a month, or $36,000 a year. Tirabassi managed more than $700 million in investments for the Secretariat of State, an amount that included proceeds from the annual “Peter’s Pence” collection.

In virtually any other organization one can imagine, such an arrangement would be considered an outrageous conflict of interest, almost certainly grounds for termination, and quite possibly also criminal.

Yet the Corriere story contains quotes from Tirabassi’s lawyers in which they don’t deny the contract with UBS, but rather insist there was no mystery about it and that Tirabassi’s superiors, who include the number two official in the Secretariat of State, currently Venezuelan Archbishop Edgar Peña Parra, not only knew about the deal but approved it as a sort of informal “fringe benefit.”

As the Corriere write-up puts it, such a situation “demonstrates how much confusion of roles, competencies and interests reign in the financial heart of the Vatican, and for who knows how long.”

The Vatican has not yet commented on the report.

Assuming the facts as presented are correct, four early take-aways suggest themselves.

First, the financial reform of the Vatican launched by Pope emeritus Benedict XVI and accelerated under Francis, while it’s made undeniable headway, remains a work in progress. Bear in mind that October 2019, when Tirabassi was suspended, was six and a half years into the Pope Francis era, and yet a senior official of the Secretariat of State allegedly was happily taking what amounted to informal kickbacks from a bank for steering business its way.

What’s worse, the suggestion, at least from his lawyers, is that higher-ups in the Secretariat of State had signed off on it.

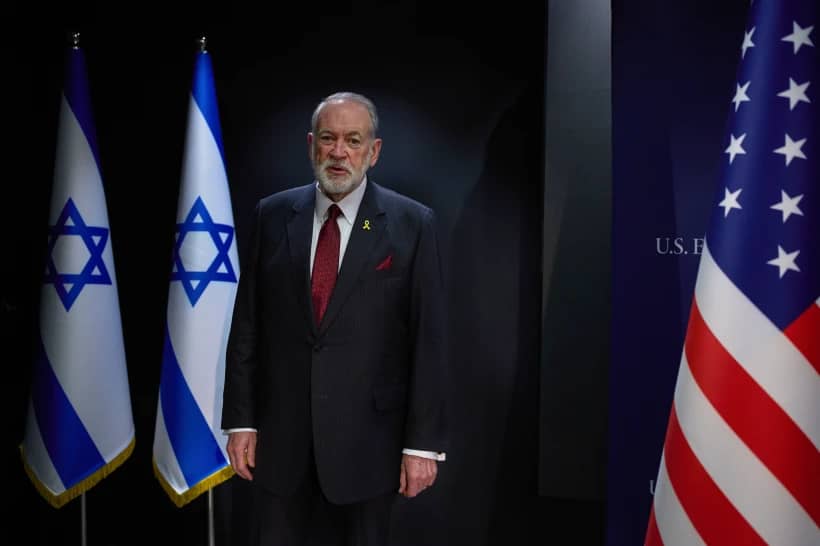

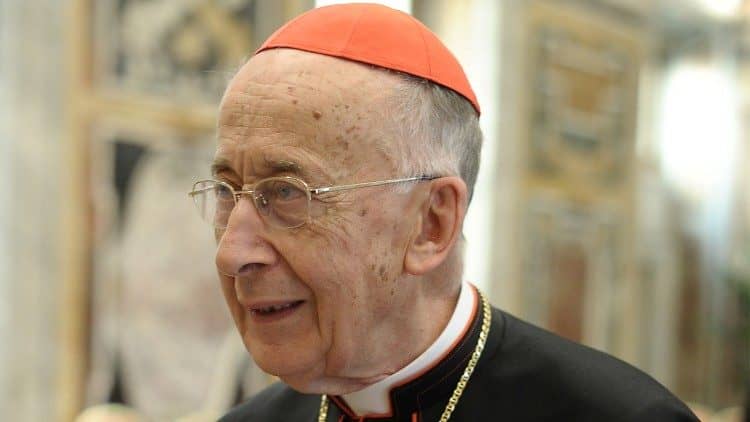

(As a footnote, the same suggestion has been made with regard to the London deal, i.e., that whatever went wrong, it had been fully approved by Cardinal Pietro Parolin, the Secretary of State, and two deputies, first then-Archbishop Angelo Becciu, now a cardinal stripped of his privileges, and Peña Parra. The delicacies of how to prosecute possible crimes when such big fish are allegedly involved, even if they’re not ultimately culpable, may help explain the slow pace of the investigation.)

Second, it’s worth underlining that the fund Tirabassi directed, and which was at the heart of the London scandal, included the Peter’s Pence income. That’s relevant because it was only through the scandal that ordinary Catholics around the world learned that, according to the statutes of the fund, their donations don’t just go to papal charities, but to whichever ends the pope decides to put them – which can include covering deficits, routine administration, and investment activity, as well as feeding the hungry and housing the homeless.

Many observers wondered how the Vatican and local churches would handle publicity for the collection this year. Spanish Jesuit Father Juan Antonio Guerrero Alves, head of the Vatican’s Secretariat for the Economy, said in a recent interview that Catholics have the right to know how they money they donate is being spent.

I don’t know what anyone else did, but in Italy, materials for the Sunday Mass included a prayer of the faithful that “all Christians will be generous in supporting the work of Pope Francis in favor of the poor and needy of the whole world.” It also featured a pastoral note under the title, “To donate is a joy,” which asserted that the collection funds “interventions of solidarity for those who have the greatest need, such as the sick, the poor or victims of war and natural disaster.”

There was no reference to the statutory provision that the pope can authorize these funds to be used in any way he sees fit, not just charity. Full transparency about the nature of the collection, therefore, may also be on the list of targets the reform hasn’t quite reached.

Third, the Tirabassi story also illustrates a persistent Vatican “talent problem.”

When you’re talking about priests, brothers and nuns, it’s arguably reasonable that you expect them to work for far less than their talent, training and experience would justify. When it comes to laity, however, there’s a somewhat different calculus. Especially in an area such as finance, how much you pay does, in some rough sense, inevitably correlate with the quality level you can attract and retain.

In Tirabassi’s case, the average investment fund manager with 20-plus years of experience in Italy makes somewhere between $102,00 to $115,000, according to the “SalaryExplorer” site, which is four times his actual Vatican salary. That may help explain, if the facts are confirmed, why his Vatican superiors were content with the UBS deal, because it probably brought him closer to what his friends and colleagues in the private sector were making.

Of course, the Vatican can’t pay competitive salaries because it just doesn’t have the money, especially right now in a time of ballooning deficits. Anyway, one is supposed to work for the Vatican out of a sense of sacrifice. Yet as kids get closer to college, mortgage payments go up and other expenses rise, laypeople who could be making significantly more elsewhere are either going to move or look for ways to supplement their income.

That’s not to excuse Tirabassi’s deal, but merely to say that the unique dynamics of the Vatican may play some part in creating what classical theology would call an “occasion of sin.”

Fourth, if the Vatican’s old guard actually held club meetings, Tirabassi would be a good candidate for an officer — not the president, as that would be reserved for a cleric, but maybe recording secretary. He was shaped by the pre-reform Vatican way of doing things, and it’s plausible that even if he really did have this deal with UBS, he may not have believed there was anything wrong with it.

In other words, it’s possible this is a case of objective corruption but not subjective sin, which makes a larger point: The real obstacle to reform isn’t structural or legal, it’s cultural. Until you fix the culture, changing laws and structures is like tossing buckets of water off the deck of the Titanic.

In the end, Tirabassi may well be indicted by Vatican prosecutors and put on trial, either for his role in the London affair, his UBS deal, or both. Whether that will amount to full justice – and especially whether it takes account of the role of his superiors in the system – is another question.

Follow John Allen on Twitter: @JohnLAllenJr