YAOUNDÉ, Cameroon – Amid rising public concerns that public investment funds could be pilfered and the savings of millions of South African workers plundered, the bishops of South Africa have called for a strengthening of the governance system in order to avoid disaster.

The Public Investment Corporation (PIC) is the largest public assets management firm in Africa, with $138 billion in assets, but 88.2 percent of its money comes from the Government Employee Pension Fund.

Now there are concerns that this money could be used to pay the debts of South African Airlines and other struggling state corporations.

Opposition began mounting in August when Finance Minister, Malusi Gigaba, told executives of the Congress of South African Trade Unions, the largest labor federation in South Africa, that the government could use the PIC to shore up publicly-owned companies.

There has been negative reaction to the proposal, especially given the ways several of these companies are known to hemorrhage money.

The Catholic bishops have joined the opposition to the plan, and are demanding that higher governance standards be introduced into the management of the PIC in order to save the life savings of millions of people.

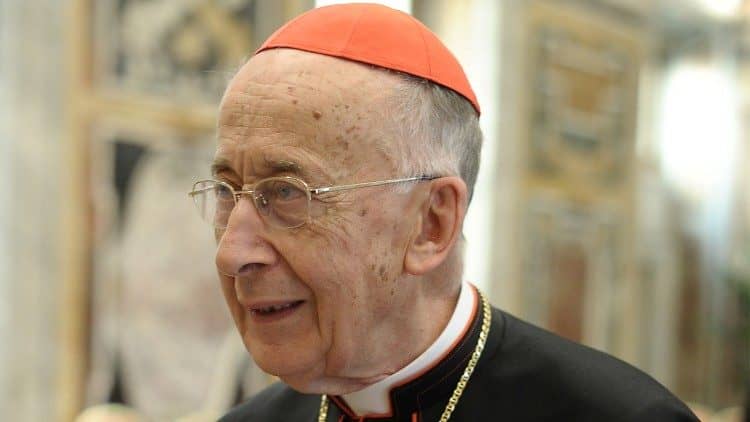

“We therefore join calls for greater involvement of the parliament in the appointment of PIC board and its chairperson. The concentration of the appointment powers in the minister of finance, without some form of parliamentary oversight, makes the PIC highly vulnerable to political interference, looting with impunity, and the negative influences of ANC factionalism,” said Bishop Abel Gabuza, chairperson of the Southern African Catholic Bishops’ Conference (SACBC) Justice and Peace Commission.

“We also want representation of workers on the PIC board and the disclosure of unlisted portfolio of PIC to be fast tracked and institutionalized,” he added.

The money manager controls the assets of several clients, including the Government Employee Pension Fund, the Unemployment Insurance Fund, and the Associated Institutions Pension Fund.

Yet, trade union associations representing thousands of workers whose money is managed by the PIC are not represented on the 11- member board that is chaired by the deputy minister of finance, Sfiso Buthelezi.

Instead, the board is composed of people with no direct connection to the workers whose money is at stake: These include accountants, city planners, and lawyers.

Now, many of the unions are threatening to pull out of the PIC if their members aren’t included on the board.

The Federation of Unions of South Africa, or Fedusa, has said it is willing to consider replacing the state-owned Public Investment Corporation with privately owned fund managers to oversee the pension funds of the state workers, including the nurses and teachers that it represents.

Fedusa is the second largest labor union federation in the country, and represents some 500,000 workers.

“There is nothing in the law that requires the Government Employee Pension Fund to use only the PIC as an asset manager,” Fedusa General Secretary Dennis George told Business Report.

A complete pullout is just one of the options the union is considering.

They are also pushing for more representation on the boards of investment firms where the PIC has put their money, and a greater say in the Government Employee Pension Fund, or GPEF, the largest pension fund on the continent, and also the biggest contributor towards PIC’s asset.

“We will occupy the space in the Government Employee Pension Fund and bring the PIC straight to order in terms of their mandate,” George said.

The Public Servants Association – the latest union to threaten a pullout – has called on the finance minister to include their members on the board of directors, as well as making sure there are labor positions on the boards of all companies, where GEPF funds are invested by PIC.

The PSA said failure to adhere to these demands will result in the union insisting that the GEPF appoints a new fund manager and so drop the PIC as “an investment vehicle.”

According to the chief executive of the Johannesburg Stock Exchange (JSE), Nicky Newton-King, the PIC owns 12 percent of the JSE Limited, which has a market capitalization of around $1 trillion. The National Treasury has also indicated that many South Africans invest through their pensions, with just over $200 billion in retirement funds.

As fears grow that workers’ pensions could be used to recapitalize failing state enterprises, the Finance Minister has called for details on how and where the money is being invested, and a list of the shareholders.

Speaking for the bishops, Gabuza said it was necessary to “add a moral voice to the outrage over alleged plans to plunder the public investment corporation and the pensions of millions of hard-working government employees and pensioners.”

The bishop said protections must be instituted for the PIC and the finance ministry to regain credibility.