ROME – With the final embers of summer waning, the resumption of the Vatican’s megatrial is drawing near, featuring several big players indicted for financial crimes amid Pope Francis’s broader reform efforts.

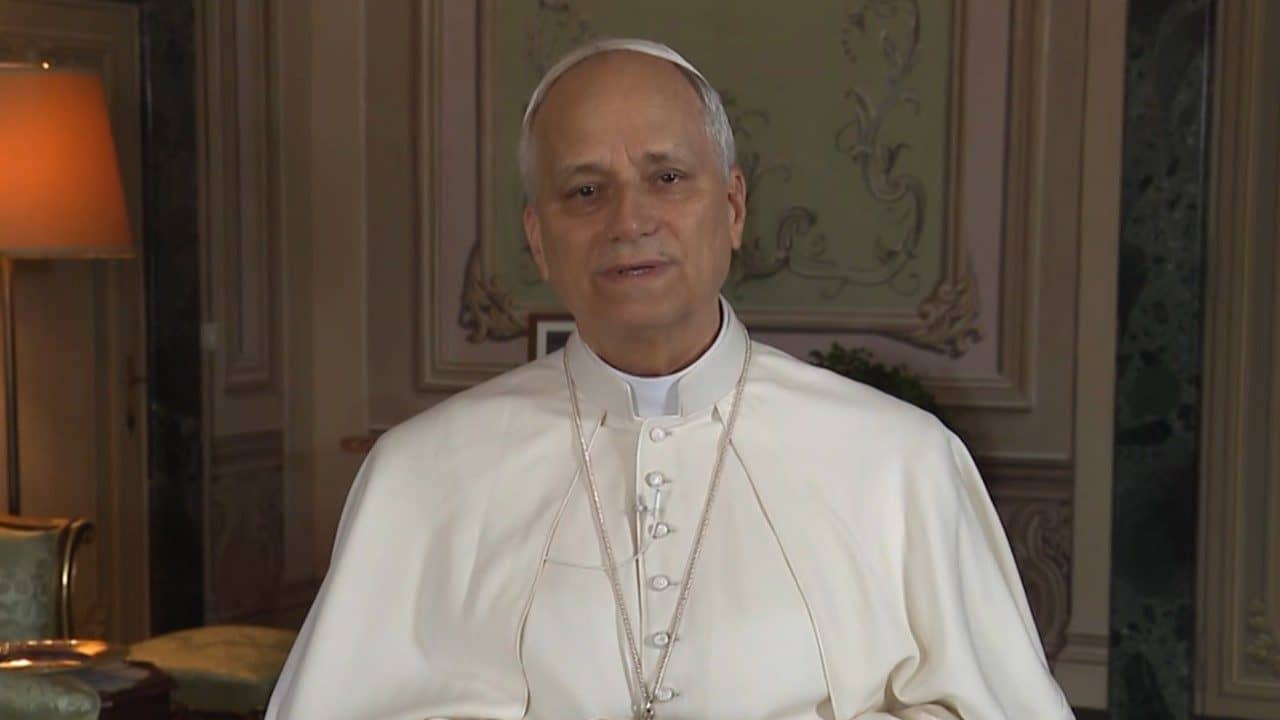

Over the summer the Vatican announced a swath of indictments against 10 people, including the once-powerful Italian Cardinal Angelo Becciu, who for years was one of the most influential Vatican officials, and who now finds himself to be the first person with a red hat to stand trial in the Vatican tribunal.

An initial trial date was set for July 27, however, during that hearing, proceedings were postponed until Oct. 5, after the summer break.

The indictments were the culmination of a two-year investigation into a shady investment in a swanky London property which ended up losing the Vatican millions in bad investments and fat fees to brokers, among other things.

Those indicted face a wide variety of charges, from abuse of office to embezzlement, extortion, and corruption.

What happened?

It all began in 2013 when the Vatican’s Secretariat of State chose to invest some 200 million euros ($232,799,000) in the Athena Capital fund operated by Italian businessman Raffaele Mincione.

Half of the money was invested into a former Harrod’s warehouse in London’s upscale Chelsea neighborhood, which was to be converted into luxury apartments, and the other half was allocated to other investments.

However, by 2018 Athena Capital had lost roughly 18 million of the Vatican’s initial investment, and the Vatican found itself allocating tens of millions in burdensome mortgage payments on a property which had largely lost its value after Brexit, and they were hemorrhaging cash in generous fees to their Italian business partners.

Holy See officials then began to seek an exit strategy while maintaining the Vatican’s stake in the London property.

As part of the Vatican’s attempted withdrawal, another Italian business broker, Gianluigi Torzi, helped orchestrate a 40-million-euro payout from the Vatican to Mincione for the shares in the London building that they didn’t already own.

Torzi is accused of essentially pulling a fast one on his Vatican interlocutors by inserting a clause into the contract giving him full voting rights in the deal, rather than creating a Vatican-controlled company to manage the London property.

When the Vatican in 2018 attempted to purchase the remaining shares in the London property to end mortgage payments, they needed a loan from the so-called Vatican Bank, known as the Institute of Religious Works (IOR), to do it.

Both the IOR’s director, who is close to Francis, and the Vatican auditor general’s office flagged the request as suspicious and sounded the alarm with the Vatican police. AIF launched an international investigation to catch the culprits cheating the Vatican out of its money, but their headquarters were later raided by Vatican prosecutors during their own investigation, and AIF’s leader, Tommaso di Ruzza, was suspended for unclear motives.

Overall, the Vatican lost 150 million pounds ($201,618,000) on the investment, which was made using funds from Peter’s Pence fund, an annual charitable collection taken up in parishes around the world to support the works of the pope.

Who’s been indicted?

In total, 10 people have been indicted for financial crimes in the London incident, including Becciu, the Italian businessmen involved, their companies, and a number of Vatican officials:

- Cardinal Angelo Becciu, former sostituto of the Vatican Secretariat of State, who is accused of embezzlement, abuse of office, and subornation.

- René Brülhart, former president of AIF, charged with abuse of office

- Monsignor Mauro Carlino, official in the Vatican Secretariat of State, charged with extortion and abuse of office

- Enrico Crasso, manager of the reserved assets of the Vatican Secretariat of State, charged with the crimes of embezzlement, corruption, extortion, money laundering and self-laundering, fraud, abuse of office, creation of a false private deed, and creation of false public deed material by a private individual

- Tommaso Di Ruzza, former director of AIF, charged with embezzlement, abuse of office, and violation of the secret of office

- Cecilia Marogna, Vatican contractor, charged with embezzlement

- Raffaele Mincione, Italian businessmen charged with embezzlement, abuse of office, misappropriation and self-laundering

- Nicola Squillace, lawyer, charged with fraud, embezzlement, money laundering and self-laundering

- Fabrizio Tirabassi, businessman, charged with corruption, extortion, embezzlement, and abuse of office

- Gianluigi Torzi, businessman, charged with extortion, embezzlement, fraud, misappropriation, money laundering and self-laundering in relation to companies

- HP Finance LLC, referable to Enrico Crasso, which is accused of fraud

- Logsic Humanitarne Dejavnosti, D.O.O., referable to Cecilia Marogna, which is charged with embezzlement

- Prestige Family Office SA, referable to Enrico Crasso, which is charged with fraud

- Sogenel Capital Investment, referable to Enrico Crasso, which is charged with fraud

The Pope’s reform

This trial takes place amid a strong push from Pope Francis to clean up the Vatican’s finances.

In the July 3 announcement of the indictments, the Vatican said the decision “is directly linked to the indications and reforms of His Holiness Pope Francis in the work of transparency and consolidation of Vatican finances.”

The Vatican’s criminal code is based on Italy’s own 1889 legal code and also incorporates elements of canon law.

Since he took office, Pope Francis has updated the Vatican’s criminal code with a swath of new financial crimes intended to address the type of problems that the London deal is so emblematic of.

Many of these new laws came amid the coronavirus lockdown in 2020, as pressure mounted for Pope Francis to not only clean up Vatican finances, but to show improvement in the prosecution of financial crimes.

This is an agenda Francis has prioritized as the Vatican faces a glaring economic crisis, made worse by the economic fallout of COVID-19, and increased pressure from European financial watchdogs.

The Vatican tribunal in particular has faced increased pressure to prosecute financial crimes by Moneyval, the European oversight body helping countries to fight money laundering and the financing of terrorism, which the Holy See participates in.

Many believe that this trial is a litmus test for just how serious the Vatican is in getting its house in order and cracking down on financial crime and could set an important precedent for when future problems arise.

A new courtroom for the trial has been set up in the Vatican Museums, as the Vatican City criminal tribunal is too small to fit each of the defendants and their lawyers.

If convicted, each of those indicted could face a punishment of fines, jail time, or both.

Follow Elise Ann Allen on Twitter: @eliseannallen