Cleaning up Vatican finances has been a major priority of Pope Francis, and that campaign reached a milestone on Friday with the release of a 2014 annual report from the Financial Information Authority (AIF), an anti-money laundering watchdog unit created under Benedict XVI and strengthened by Francis.

The report’s main assertion was that the Vatican now has a financial regulatory system in line with international best practices, flagging suspicious transactions and, when warranted, turning them over for criminal prosecution.

The report showed that after collecting only six reports of suspicious transactions in 2012, AIF received 202 in 2013 and 147 in 2014. It cited those totals as proof of “substantial improvement in the operational performance of the supervised entities,” mostly meaning the Vatican bank, as well as “full implementation” of the Vatican’s new legal framework.

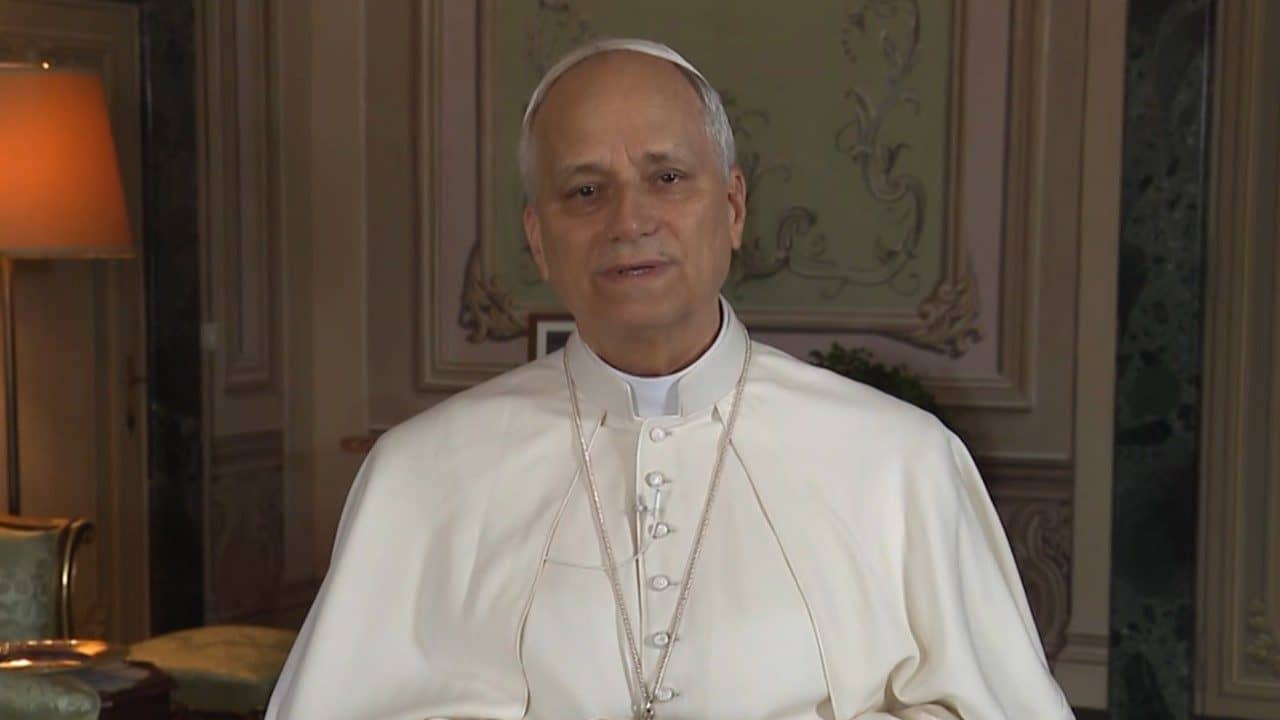

AIF’s president is a 43-year-old Swiss lawyer named René Brülhart, whose previous claim to fame was helping to turn around Liechtenstein’s reputation as a financial pariah as director of its financial intelligence unit from 2004 to 2012.

Since arriving in Rome in November 2012, Brülhart has quietly helped steer the Vatican away from several potential disasters, such as the suspension of credit card services by the Bank of Italy in January 2013 and the arrest of a former Vatican accountant on money-laundering and cash-smuggling charges in June 2013.

On Monday, Brülhart spoke to Crux about the annual report and the broader project of reform, insisting that the Vatican now has a “state of the art” framework to fight financial crime.

Crux: What’s the significance of this report?

Brülhart: It shows that a full-fledged legal framework, as well as an institutional and supervisory framework, are now in place and that implementation is moving forward.

The key is “prudential supervision.” Under Law 18, an anti-money laundering law adopted in October 2013, for the first time we have the supervisory authority to ensure that financial institutions have the right procedures in place to provide certain services, to meet their capital requirements, to ensure good governance, and so on.

That law, along with a 130-page regulation issued in January after being adopted by our board last September, outlines the formal requirements needed to fight money laundering and financial crime in general.

When you say “financial institutions,” do you mainly mean the Vatican bank?

Primarily it’s the bank, and to some extent the Administration of the Patrimony of the Apostolic See. (Note: That’s the department that oversees Vatican real estate, known by its Italian acronym APSA.) At the moment, they’re the only ones carrying out professional financial activities. However, the law is written in such a way that if other such entities are created in the future, AIF would also have a supervisory role.

If the Vatican creates an Asset Management Office to handle its investment portfolio, as some have suggested, it would fall under AIF’s responsibility?

Yes, that’s how the law is written.

How do you explain the drop in suspicious transaction reports from 2013 to 2014?

You have to go back to 2011 and 2012, because that’s when the remediation process of reviewing all accounts at the Vatican bank got underway. Putting the last two years together, we’ve received around 350 reports, and that number goes hand-in-hand with what was happening at the bank.

Going forward, I think it’s fair to say we now have a functioning system in place and in future years I expect the number of reports to be significantly lower.

Another factor is that the level of cash transactions has decreased. Cash has always been important to the Vatican as a global institution, in part because in parts of the world such as Africa and Asia, often the banking sector sometimes is unreliable and the only way to handle money is in cash. Today, with the increased use of credit cards and electronic payment services, that’s less true.

In general, it’s also fair to say that systems in the Vatican have been professionalized in a way that makes suspicious transactions less likely. One more factor [in explaining the drop] is that several accounts in the Vatican bank within a large turnover of cash have been closed.

The report says seven suspicious transactions have been referred to the Vatican’s Promoter of Justice for investigation. Have there been any prosecutions?

The investigations are still going on. What we don’t have yet are any convictions, because these things take time, especially when you need international cooperation to complete the investigation.

In the future, I expect that there will be convictions.

One hears about resistance to reform from the Vatican’s old guard. Have you run into it?

On my end, I’ve felt tremendous support. In a reasonably short amount of time, just two and a half years, we’ve overhauled the legal and institutional framework, made significant progress on implementation, and signed memoranda of understanding with the financial intelligence units of many other states such as the United States and Germany. That would not have happened if we didn’t have backing at the top.

For sure, when you build a new system, not everybody is going to be happy about it at first. It takes lots of dialogue, so people can understand what you’re trying to accomplish. At times you have to explain things again and again. Today, I think – or, at least, I hope – most people have a better understanding.

Reform began both under internal pressure, meaning the desire to avoid scandal, and external pressure, meaning the international financial system could freeze the Vatican out if it doesn’t play by the rules. Which has been more important?

I wasn’t here when it began under Benedict XVI, so I can’t speak to which one was more decisive. What I can say is that today my attitude boils down to this: We want to do it, and we also have to do it.

You know the world of international financial regulation. Do you think your colleagues now see the Vatican as having cleaned up its act?

Absolutely, yes. An example is that the European Union and the Vatican signed a monetary agreement in 2009/2010 allowing the Vatican to use the euro as the currency. One element was that the Vatican was supposed to fully implement all of the EU’s anti-money laundering laws, some of which don’t make sense because the Vatican is a unique kind of state.

Recently the European authorities acknowledged in an ad-hoc arrangement that the system we’ve developed, which is tailor-made for the Vatican’s circumstances, satisfies the terms of the agreement.

What’s the significance of the memoranda of understanding with a variety of countries, including the United States?

It’s a sign of growing international cooperation, and it’s also important that we’ve begun signing agreements with the supervisory regulators of other countries. That’s a massive step forward, because it’s an acknowledgement that our legal framework is state of the art.

The agreements allow us to exchange information more easily. For example, if we’re looking into a transaction that involves corresponding activity with a German or US bank, or that was denominated in US dollars, we can go to the US authorities to verify what happened.

Today a new system has been largely constructed, and international cooperation is working well. We have the tools in our hands, and if there’s any illegal activity, we’ll take action.