ROME— More than 540 suspicious financial transactions in the Vatican were flagged in 2015, leading to the suspension of eight of those transactions totaling over $10 million, and the freezing of four accounts at the Vatican bank worth another $8 million.

Those figures came from an annual report released Thursday by the Vatican’s financial watchdog unit, the Financial Information Authority, which was launched under emeritus Pope Benedict XVI in 2010.

In terms of the number of red flags raised, the total of 544 from 2015 represents a substantial increase from 147 in 2014 and 202 in 2013.

However, only 17 of those cases led to reports forwarded to the Promoter of Justice in the Vatican City State’s tribunal for investigation, which means that, upon review, only a handful was judged possibly to be the result of criminal activity.

“We’re talking about suspicion, not evidence,” said René Brülhart, President of the Vatican’s Financial Information Authority, in presenting Thursday’s report.

The Swiss anti-money laundering expert said his office has put a system in place which allows the Vatican to freeze assets or block transactions on the basis of doubts about legitimacy, but then it’s up to the Vatican’s tribunal, through its law enforcement powers, to gather the corresponding evidence.

According to AIF, the upward trend in the reporting of suspicious activities, which began in the fourth quarter of 2012, is the result of “the strengthening of whistleblowing, cooperation and information exchange systems,” both within the Vatican and in cooperation with third parties such as other states.

With full autonomy, AIF supervises and regulates Vatican entities that carry out financial activities to prevent and counter money laundering and the financing of terrorism, and also performs financial intelligence activities.

In practice, this means AIF reviews transactions carried out both by the Administration of the Patrimony of the Holy See (APSA), which controls the Vatican’s real estate holdings, and the Institute for the Works of Religion (IOR), often referred to as the “Vatican bank.”

AIF was created by Pope Benedict XVI in 2010 to comply with international anti-money-laundering norms, and, more broadly, to break with the Vatican’s reputation over the years as a haven for shady financial transactions.

The new report was presented at a Vatican press conference on Thursday by Brülhart and Italian layman Tommaso Di Ruzza, the director of AIF.

Hired in 2012, Brülhart is considered the Vatican’s transparency guru. His previous claim to fame was helping to turn around the reputation of the tiny European principality of Liechtenstein’s as a financial pariah.

Since arriving in Rome in November 2012, Brülhart has helped steer the Vatican away from several potential disasters, including the suspension of credit card services by the Bank of Italy in January 2013 and the arrest of a former Vatican accountant on money-laundering and cash-smuggling charges a month later.

“International cooperation remains a key commitment of AIF,” Brülhart said. “Additional memoranda of understanding with competent authorities of other jurisdictions were signed [in 2015] and the exchange of information on a bilateral level has increased significantly.”

On the difference between the number of suspicious activities flagged and those actually presented to the Vatican’s promoter of justice for prosecution, Brülhart said that the idea is for both to be zero, “but this doesn’t reflect reality.”

“Wherever you have financial activities, you always see something potentially suspicious,” he said.

Brülhart stressed that the number of activities flagged is normal because it reflects the establishment of a system where the threshold was purposely set on the low end, in order to “change the mentality and raise awareness.”

With time, he predicted, the amount of activities flagged and those that merit an investigation from law enforcement will become closer.

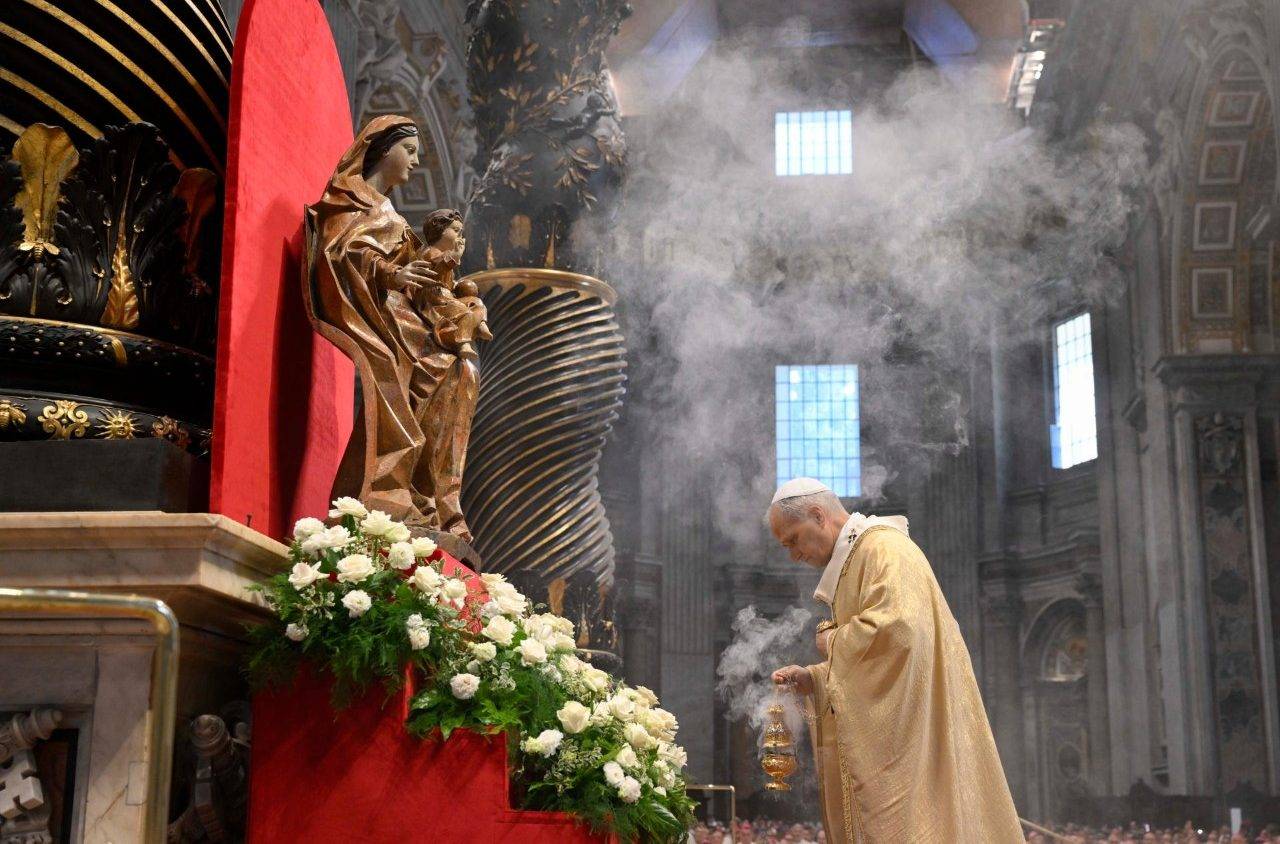

While the document was being presented, Pope Francis visited two of the Vatican’s financial offices: The Administration of the Patrimony of the Holy See, and the Secretariat for the Economy.

Di Ruzza, Director of AIF, said that during 2015 the Vatican was more proactive in asking other agencies to provide information regarding suspicious transactions, instead of waiting for others to flag the problems.

According to the report, in 2014 the number of requests made was 20, while the Vatican received 93 such requests from the outside. Last year, however, the number was higher on the Vatican side, requesting information to foreign authorities on 199 occasions while receiving 181.