ROME – We’ve been down this road before, of course, but nevertheless we witnessed what’s being hailed as a landmark moment this week for financial reform in the Vatican when a longtime former president of the Vatican Bank, along with the bank’s lawyer, were sentenced to eight years and 11 months in jail for their roles in a $70 million fraud.

The lawyer’s son, who was also charged in the scheme, got five years and two months.

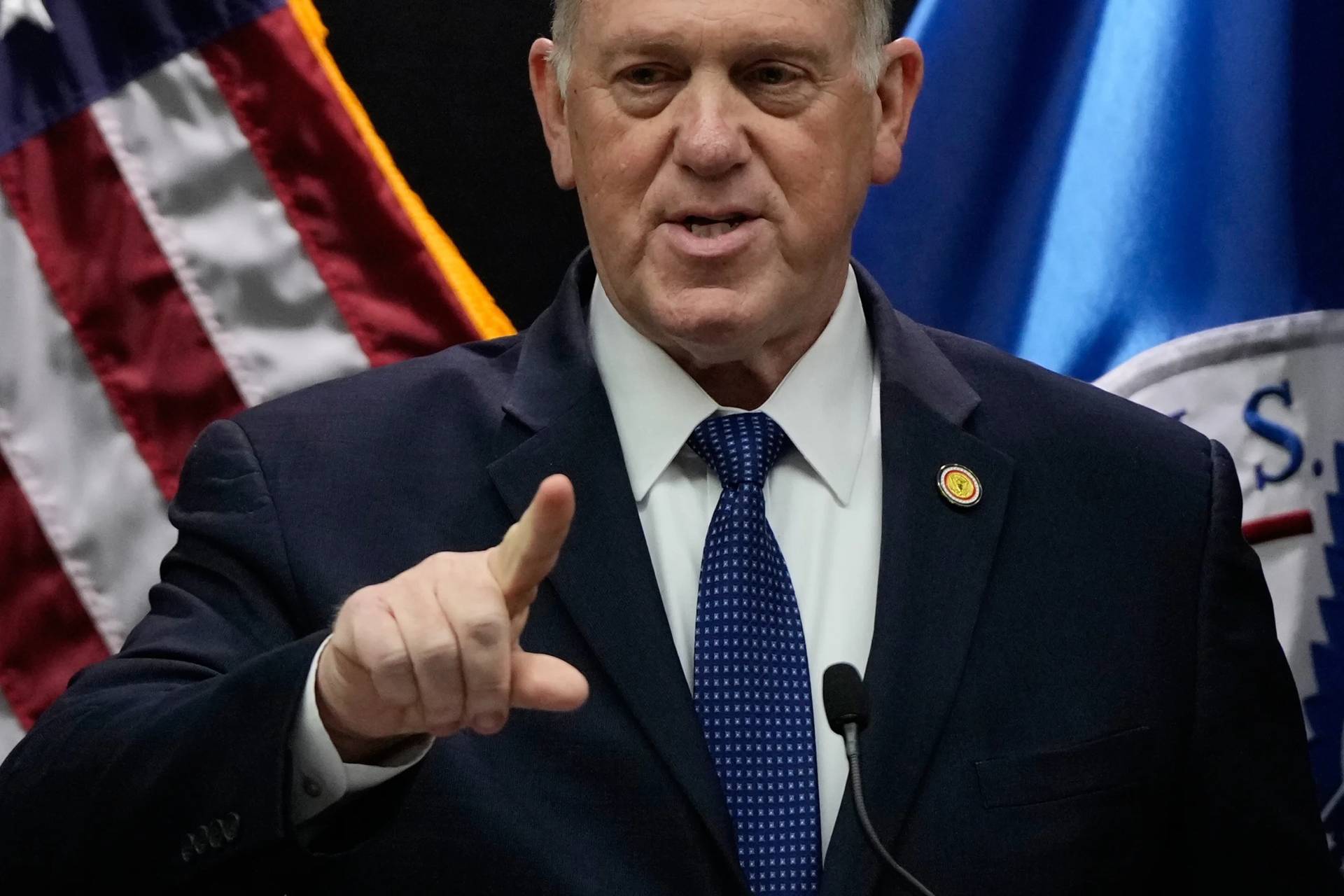

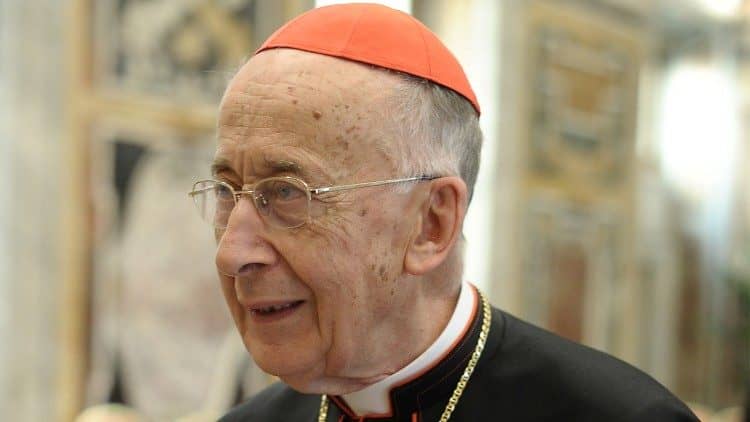

Basically, the accusation was that Angelo Caloia, the former Vatican Bank president, along with Gabriele Liuzzo, the lawyer, and his son Lamberto, were part of a complicated scheme to sell about 70 percent of the property that belong to the Vatican Bank at the time, which included some top-shelf apartments in Rome, Milan and Genova, at prices significantly below their real market value, in exchange for kickbacks.

All in, the Vatican Bank is believed to have lost about $70 million relative to what the property sales would have earned at full price, and the three accused are believed to have pocketed a good chunk of that money. Accounts in their name containing almost $30 million have been confiscated.

The three have also been hit with fines as part of their sentences, and barred from ever holding office in the Vatican again.

To be clear, Caloia wasn’t just any target. When I first arrived on the Vatican scene in the late 1990s, he’d already been running the Vatican Bank for almost a decade. He took over from the legendary American Archbishop Paul Marcinkus, who was in charge during the infamous Vatican bank scandals of the 1970s and early 1980s.

(As a technical matter, there is no such thing as the “Vatican bank.” Its name is actually the “Institute for the Works of Religion,” and it’s more like a cross between a credit union and an investment fund than a bank – among other things, it doesn’t make loans, it doesn’t hold any reserves, and it’s a non-profit entity. Still, the phrase “Vatican bank” is so etched in the popular mind, why fight it?)

Caloia was in power for so long, he was practically regarded among Vatican insiders as immortal. Thus, to see him convicted by a Vatican court is undeniably jarring. The current lawyer for the Vatican bank, Alessandro Benedetti, said the verdict make a statement.

“The message is that the party is over,” Benedetti said. “Today, there’s zero tolerance for behavior that plunders the institute,” using the place’s formal name.

This is not only the first time that such a senior Vatican official has been convicted of financial crimes, it’s also the first time such a prosecution has been entirely the Vatican’s initiative. In the handful of cases in the past when the Vatican has prosecuted someone for such an offense, the case actually began as an Italian civil investigation or was reported by outside parties, with the Vatican more or less forced to react.

In this instance, however, from the initial report to the verdict, this was a Vatican undertaking, suggesting that the reforms of the Vatican bank launched under Pope emeritus Benedict XVI and amplified under Pope Francis have taken hold.

In other words, this looks like a good news story vis-à-vis reform, right? Well, hold on.

First of all, despite headlines claiming, “Vatican official given eight-year sentence for fraud scheme,” which makes it sound as if Caloia was headed to jail immediately after the verdict was proclaimed, it’s not so.

In the Vatican’s system of criminal justice, which is based largely on Italy’s, a sentence isn’t actually imposed until the defendant has exhausted his or her appeals. There are two levels of appeal in the Vatican, and sometimes the hearings necessary to reach a verdict can drag on for years.

Caiola right now is 81, while the elder Liuzzo is 97. Their ages, combined with the procedural complexities, render it fairly unlikely that either man will ever see the inside of a jail cell. Caloia’s lawyers say they’ve already filed his appeal.

Further, even if you could get to a definitive verdict while at least one of the two is still alive, implementing it would require an extradition agreement with the Italian government, and it’s not clear right now whether that would happen. (To some extent it might depend on who’s running Italy then, since the current government may be about to fall, but that’s another story.)

It’s also worth noting that the way of running the Vatican bank indicted and convicted in this case doesn’t exist anymore, and hasn’t for a while. Today, the Vatican bank is no longer a property owner, it’s under the strict surveillance of the Vatican’s Financial Information Authority, and it’s got a high-powered board made up of financial professionals with reputations at stake should they be caught in any shenanigans.

(The lineup includes the former Vice President and Chief Investments Officer of the University of Notre Dame, Scott Malpass, who oversaw assets worth $14 billion, which is far more than the Vatican’s own net worth.)

The crimes in question occurred between 2001 and 2008, meaning between 15 and 20 years ago – and, notably, when another pope was in charge.

In other words, this isn’t so much accountability for the present as for the past. It’s not the same as if somebody as high up as Caloia were convicted for, say, the London real estate scandal that’s still unfolding on Pope Francis’s own watch.

Nonetheless, the truth is that few victories or defeats are ever truly complete. Whatever the question marks may be, the Caloia conviction represents a warning to anyone in power today that however long it takes, they can never be sure a knock on the door won’t come someday if they put their hands in the cookie jar.

That alone, perhaps, is enough to qualify the case as a watershed – and, in an institution in which money and accountability historically have been like distant cousins, usually not on speaking terms, even a partial rapprochement can’t help but seem like progress.

Follow John Allen on Twitter at @JohnLAllenJr.