ROME – From the beginning, cleaning up Vatican finances has been a major priority of Pope Francis. That campaign took a step forward Tuesday with the release of the 2016 report from the Financial Information Authority (AIF), in effect the Vatican’s financial watchdog unit, suggesting a significant drop in reports of suspicious activity.

However, AIF leadership also acknowledged that to date, there have been no publicly known instances in which someone accused of financial wrongdoing has been prosecuted and punished by the Vatican’s legal system.

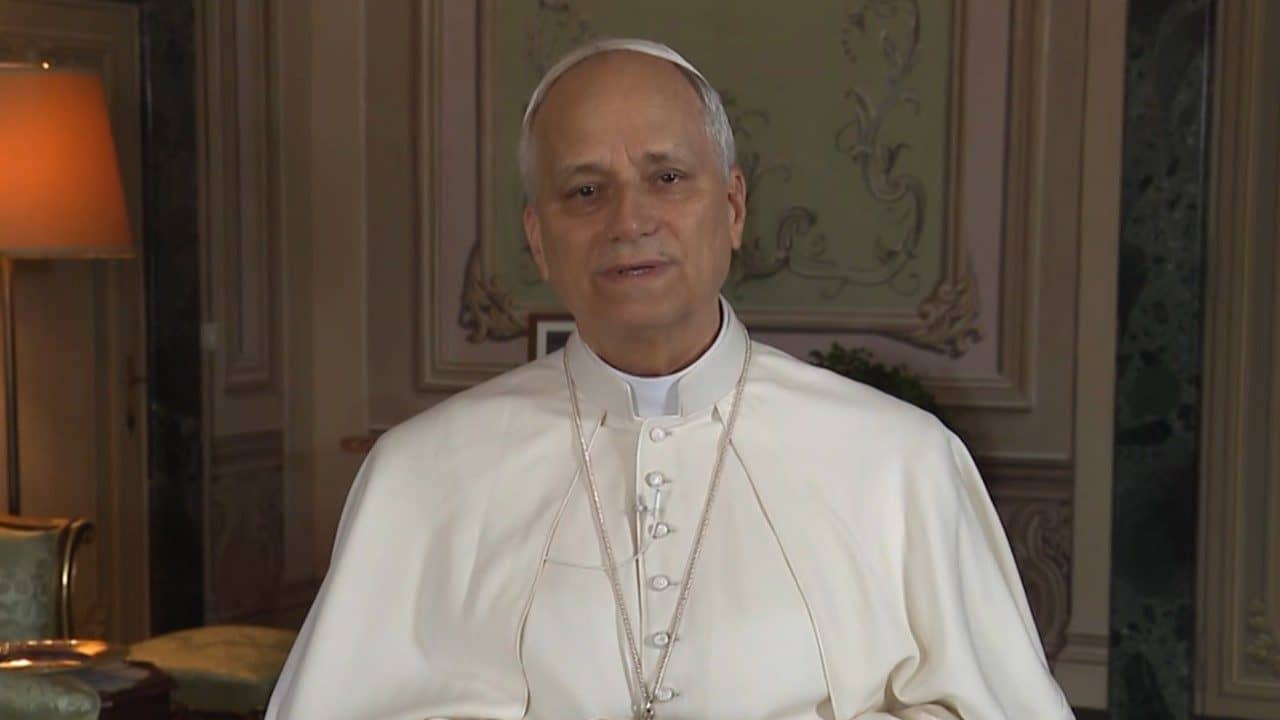

AIF is an anti-money laundering watchdog unit created under Benedict XVI and strengthened by Francis. It’s headed by Swiss lawyer René Brülhart, with Italian Tommaso Di Ruzza serving as director.

More than 190 suspicious financial transactions in the Vatican were flagged in 2016, leading to the suspension of four of those transactions totaling over $2 million, and the freezing of one account at the Vatican bank worth another $1.5 million.

The numbers represent a notable decrease from 2015, when there were 540 suspicious transactions, eight suspended, totaling over $10 million, and freezing four accounts in the Vatican bank worth another $8.

According to Brülhart, the AIF’s president, this decrease is “no surprise, but a logical follow-up to the path we have been taking these years.”

Since its inception, Brülhart said, AIF has been steadily trying to set up not only a functional system for the Vatican’s finances, but a “sustainable one.”

Brülhart’s previous claim to fame was helping to turn around Liechtenstein’s reputation as a financial pariah as director of its financial intelligence unit from 2004 to 2012.

Brülhart and Di Ruzza spoke with the press on Tuesday to present the fifth annual AIF report. Beyond statistics, the report also indicates “an ever-increasing and effective implementation of reporting requirements.”

In the report’s introduction, Di Ruzza explains the decrease in suspicious activity reports, saying that this stabilization is due to several factors, including more efficient controls implemented in the Institute for the Works of Religion, known in the street as the Vatican Bank.

RELATED: The Vatican’s quiet reformer

One of the issues the two officers of AIF were asked about most were the 22 recommendations for possible prosecution made to the Vatican’s Office of the Promoter of Justice last year, adding to the 34 made during 2012-2015. These reports include various financial crimes, from tax evasion to misappropriation and corruption.

Up to this point, there’s been no announcement of cases brought to justice by the promoter, Gian Piero Milano. Back in February, the Italian layman said two cases had gone to trial for the first time in 2016, but it’s unknown what these cases involve.

It’s a far cry from the notorious “Vatileaks 2″ trial, when three former members of a Vatican commission and two journalists were accused of revealing confidential information, and it all played out in broad daylight.

“I cannot speak for the Promoter of Justice,” Brülhart said. “However, there have been relevant developments in recent times,” without elaborating on what that meant.

Yet the Swiss expert believes that most of the backlog can be explained by the fact that the system they’ve established is still new, and that IT resources, qualified people and context are needed to develop the cases flagged by AIF and then forwarded to the prosecutor.

In addition, Milano’s office has to request information to international agencies as part of the process, often slowing things down further.

However, the Vatican is facing a ticking clock. The Council of Europe’s anti-money laundering unit, known as Moneyval, is due to present an interim report on the Holy See this December, after finding in 2015 that there had been “no real result” in terms of imposing accountability for financial crimes.

Brülhart spoke about Moneyval, saying that body gave “a lot of credit” to the Holy see for the “progress that has been done.”

“I would call it a very constructive bond,” he said.

One of the key issues present in Tuesday’s report was the fact that the cooperation between AIF and its international counterparts has grown.

“International co-operation is a precondition for countering financial crimes, and the Vatican is fully committed to this front,” Brülhart said. “In 2016, the AIF has seen a significant increase in bilateral cooperation with the competent authorities of other jurisdictions and will continue to be an active partner in combating illicit financial activities globally.”

To this end, during 2016 the Vatican made over 700 requests to foreign authorities, up from the 199 made in 2015. It also received 116, down from 181 from the previous year.

The Vatican’s financial sector is unique in the sense that it provides services primarily to support the Holy See and the Church in the world.

“By its nature, it has an international projection, including those critical areas and regions sometimes in which the Church, for various reasons, is present with its pastoral and humanitarian activities,” Di Ruzza wrote in the report.

“While retaining its own uniqueness, it therefore shares the inherent challenges and complexities of the current international scenario,” he added.

AIF, created in 2010 by Benedict XVI, is one of the several financial entities in the Vatican. Others include the Secretariat for the Economy and the Council for the Economy, both instituted by Pope Francis.