ROME – Vatican Bank officials are going to court in Malta to seek damages over investments made in 2013, in a move the Vatican spokesman said was a “willingness to accept responsibility for past abuses.”

Details of the case are sketchy, but on Tuesday the Vatican issued a statement saying, “In the last few days, the Institute for the Works of Religion (IOR) started a civil action before the competent Maltese judicial authorities against various third parties deemed liable of having caused significant damages to IOR in connection with certain investment transactions in which it participated.”

The Institute for the Works of Religion is commonly called the Vatican Bank.

“This initiative confirms IOR’ s commitment, in the interest of transparency, to report to the competent authorities any potential abuses perpetrated against it and to take, as in this instance, any appropriate action to protect its financial and reputational interests, including outside of the Vatican City State,” the statement read.

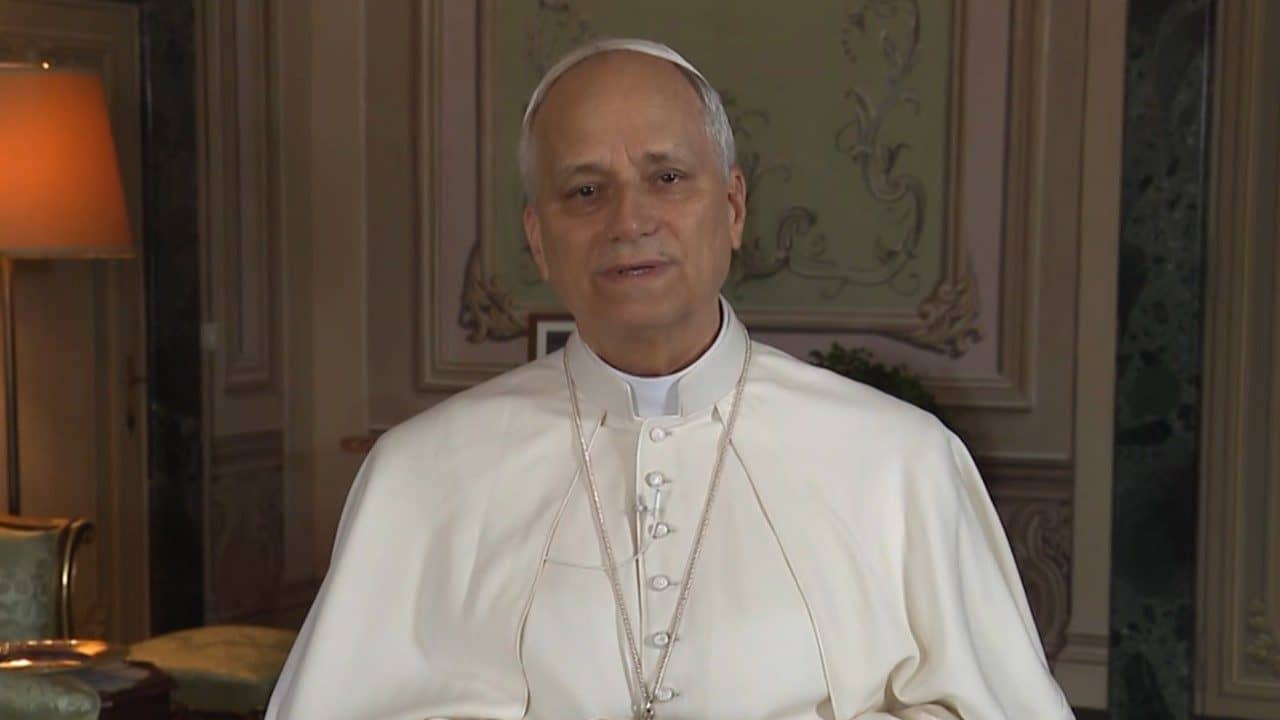

Greg Burke, the Vatican spokesman, later said the “investment transactions” dated back to 2013, and involved around $20 million, although he said any damages would have to be set by the Maltese courts.

“This action demonstrates the will of the IOR to accept responsibility for past abuses,” Burke said.

RELATED: Ex-Vatican auditor says he was forced out by old guard with ‘frame-job’

Over the years the IOR has been involved in numerous controversies, most famously its involvement with the Banco Ambrosiano, which collapsed in 1982 after accusations of fraudulent deals involving the IOR.

The chairman of the bank, Roberto Calvi, fled Italy after the scandal came to light, and was later found hanging from Blackfriars Bridge in London. Although his death was at first ruled a suicide, a coroner later said the case was “open.”

The day before his body was found, his personal secretary, Graziella Corrocher, killed herself by jumping out of a window at the Banco Ambrosiano’s headquarters in Milan, leaving a note blaming Calvi for the bank’s misfortunes.

Pope John Paul II instituted a reform of the institution’s governing structure in 1990, but scandals continued.

In 2010, Pope Benedict XVI created the Financial Information Authority, known by its Italian acronym “AIF,” to act as a financial watchdog unit for the Vatican.

In 2013, the AIF conducted a detailed review of all 19,000 accounts at the IOR, and closed any unauthorized accounts (the Vatican bank is supposed only to be used by religious organizations and Vatican employees.)

RELATED: Vatican’s financial watchdog cites progress

In addition, the Vatican has signed numerous bilateral agreements with other countries – including Italy and the United States – to share financial information. The agreements are designed to fight money laundering and tax evasion, and to keep the Vatican Bank from being used as an offshore tax haven.

Benedict also allowed an outside agency to review the Vatican’s efforts on financial reform for the first time in history, inviting Moneyval, the Council of Europe’s anti-money laundering agency, to inspect the Vatican’s financial operations.

In December 2015, Moneyval issued a report saying there had been “no real results” in prosecutions of financial crimes by Vatican law enforcement, nor even confiscations of assets.

RELATED: Vatican trial finds ‘opaqueness’, ‘disorder’ in handling of papal finances

The ongoing trial of Giuseppe Profiti, the former president of the Vatican-owned Bambino Gesù pediatric hospital, who is accused of diverting roughly $500,000 of hospital funds for the renovation of a cardinal’s apartment, is the first prosecution under the Vatican’s financial crimes legislation, and considered by many a test case to show the seriousness of Vatican reform.

The next Moneval review is due in two months.