YAOUNDÉ, Cameroon – As the world reels from the COVID-19 pandemic, the poorest nations are suffering another problem: Crippling debt that has become nearly impossible to pay after the economic downturn caused by the coronavirus crisis.

In sub-Saharan Africa, even before the pandemic the total debt burden had climbed nearly 150 percent – to $583 billion – between 2008 and 2018, according to the World Bank. Average public debt increasing from 40 percent of GDP in 2010 to 59 percent in 2018.

“Even before the coronavirus crisis hit, 34 countries were already in debt default or at high risk of being so and 64 developing countries were already spending more on debt payments to other governments or institutions than they were on their own countries’ healthcare,” said Dario Kenner, the lead analyst on sustainable economic development for CAFOD, the international development agency of the bishops’ conference of England and Wales.

“For sub-Saharan Africa, the main government budget expenditure is on debt payments. This is now a lot more difficult to meet because the economic slowdown around the world has led to a collapse in the price of raw materials like oil and copper, on which many developing country economies depend. Many countries are also being hit by falling tourism revenues, loss of remittances – money sent back home by family members overseas – and other falls in demand for exports,” he told Crux.

Recently, CAFOD published a reflection by Francis Stewart, of the Jesuit Center for Theology Reflection (JCTR) in Zambia, saying the Church has always been careful when speaking about debt obligations.

“As part of the heritage of the three Abrahamic faiths, Islam, Judaism, and Christianity, it is critical of usury – the practice of making money by lending, of using debt as an instrument of profit. Therefore, according to CST, debt obligations are only moral obligations if they are entered into freely and justly,” Stewart wrote.

Kenner alludes to this theory when he says much of the debt incurred by developing countries are not freely and justly negotiated.

“Poorer countries have no choice but to continue borrowing. and then pay back high interest, because their governments do not have enough income to meet the needs of their populations,” he told Crux.

He said there were many complex reasons for the paucity of income in poorer countries, but “a major contributing factor is that too much money leaves through things like tax avoidance and evasion.”

With COVID-19 making life even harder for people in developing countries and forcing them into new cycles of borrowing, CAFOD has launched a campaign asking donor countries not only to suspend the debts of poorer countries, but to cancel them altogether.

“Cancelling debt payments is the fastest way to keep money within countries. This can help countries to increase spending on healthcare, provide a safety net to the most vulnerable people and finance the rebuilding of their economies,” Kenner told Crux.

“Debt cancellation should not be seen as a question of mercy or forgiveness, but as a question of justice and survival,” he said.

CAFOD has pointed to the experience of Zambia, which had much of its debt forgiven in 2000: This led to an increase in government spending on the health sector, including funding antivirals to battle the country’s HIV/AIDS crisis.

Kenner told Crux that the net-positive effects of debt cancellation has summoned the energies of the organization’s supporters to mobilize again “because many campaigned for debt relief 20 years ago” during the Jubilee declared for the year 2000.

But how debt relief funds have frequently been managed has always been a point of controversy in Africa. Governments have frequently come under fire for mismanaging not only borrowed money, but also poorly managing funds released when debts are cancelled.

“Badly managed debt can reverse developmental progress made over the past 20 years. The key is how the debt is managed, “said Lesetja Kganyago, the governor of the South Africa Reserve Bank.

Kenner agreed, and called for sufficient checks and balances to be built into any political system and space for civil society to hold governments to account for their policies and spending.

“CAFOD’s network of trusted local experts includes groups such as ZimCODD in Zimbabwe who are tracking government budgets and speaking out,” he said.

“After 36 poor countries had their debts cancelled between 1998-2010, governments increased investment in education and healthcare. This was reflected in improvements in child mortality and the number of children going to primary school. Key to this change was monitoring of government budgets by civil society organizations,” Kenner said.

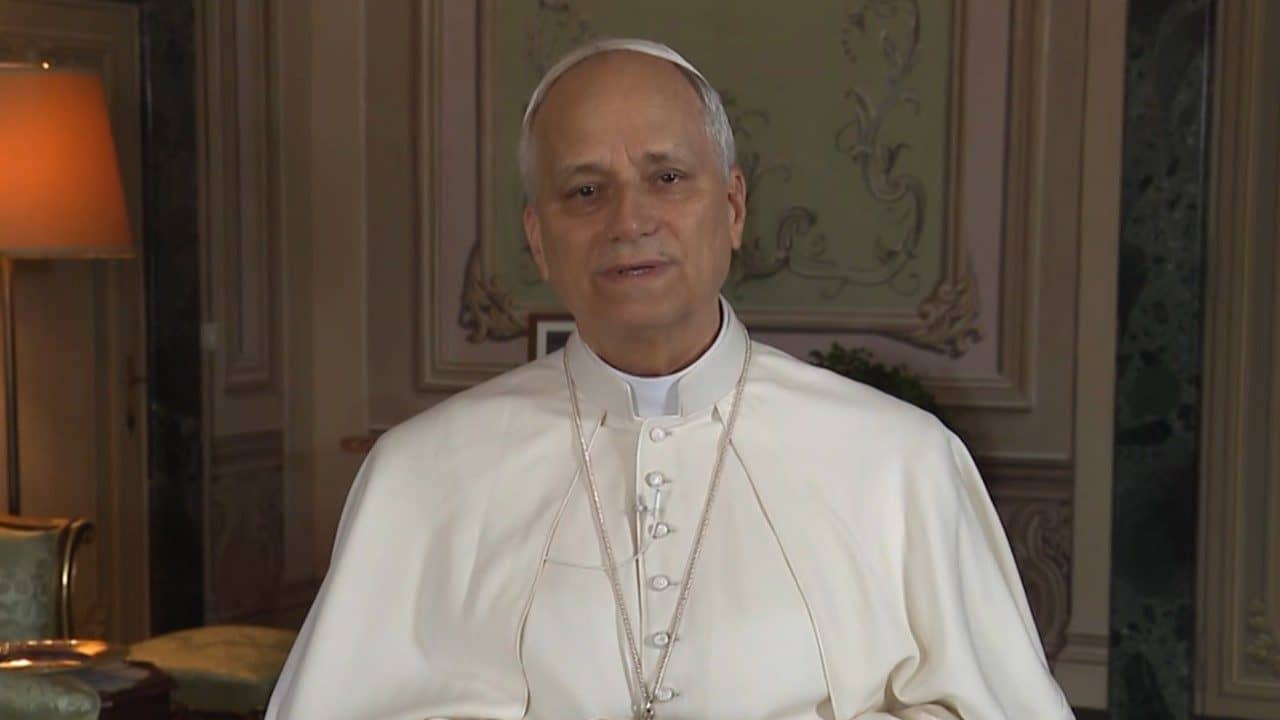

The campaign for debt forgiveness has support from the very top in the Church: On April 12, Pope Francis used his annual Easter message to call on “all nations be put in a position to meet the greatest needs of the moment through the reduction, if not the forgiveness, of the debt burdening the balance sheets of the poorest nations.”

Just a few days later, the G20 agreed to suspend debt payments — but not cancel the debt altogether — for 76 countries, including about 40 in sub-Saharan Africa.