MANILA, Philippines — A Catholic bishop in the northernmost island of the Philippines has appealed for prayers and help for victims of twin earthquakes that rocked Batanes province July 27.

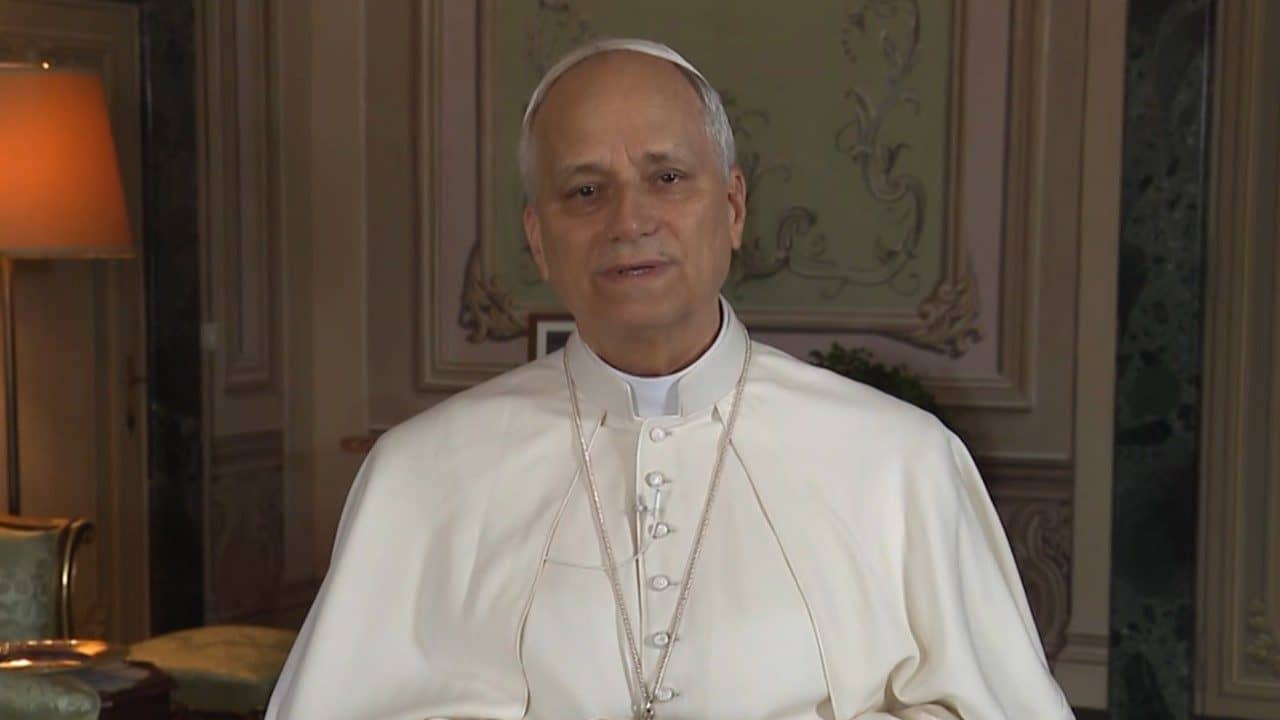

Bishop Danilo Ulep of the Batanes prelature said he sent a team to Itbayat, the hardest-hit town, to assess the situation, ucanews.com reported.

“Right now, all we are accepting is financial assistance because other needs like food, water, medicines, etc. are being addressed by the government,” Ulep said.

The earthquakes, of magnitudes 5.4 and 6.4, killed at least eight people, injured 63. One person was reported missing.

The government’s National Disaster Risk Reduction and Management Council recorded 180 aftershocks by July 28.

“The entire island was shaken so I’m under the impression that everybody is affected,” Mark Timbal, council spokesman, said.

He said residents have been advised not to enter buildings due to the risk of collapse, adding that temporary shelters have been established for residents.

Citing initial reports from the affected area, Timbal said 15 houses, two schools, two health facilities, and a church were severely damaged by the temblors and that other substantial damage was reported.

Authorities said about 3,000 people were affected.

Church leaders, meanwhile, warned against scammers out to take advantage of people who need help.

Father Ronaldo Manabat, vice chancellor of the prelature, cautioned the public against a Facebook account using the name of Ulep.

He said someone behind the “fake account” is raising money to supposedly help earthquake victims in Itbayat. The prelature also urged the public to watch out for false charities, especially using the name of the local church.

Crux is dedicated to smart, wired and independent reporting on the Vatican and worldwide Catholic Church. That kind of reporting doesn’t come cheap, and we need your support. You can help Crux by giving a small amount monthly, or with a onetime gift. Please remember, Crux is a for-profit organization, so contributions are not tax-deductible.