ROME – Two things which, at first blush, may seem mutually contradictory nevertheless have been true about Catholicism for millennia. The first is that the Church genuinely cares about the poor and social justice, and the other is that the Church has a fair amount of money and isn’t anxious to just give it all away.

How to put the square peg of preaching poverty into the round hole of funding Church operations is precisely where “impact investing” enters the picture, with the third major Vatican conference on the subject having unfolded in Rome July 8-11.

The conference was organized by Catholic Relief Services, the official overseas development arm of the U.S. bishops, along with Caritas Internationalis, the global federation of Catholic charities, and the Vatican’s Dicastery for the Promotion of Integral Human Development.

From the Catholic side, the novelty of impact investing is that it puts the Church’s preachers and its money managers into conversation, trying to find ways both to serve the poor and serve the bottom line by investing in innovative ideas that bring both change and profit.

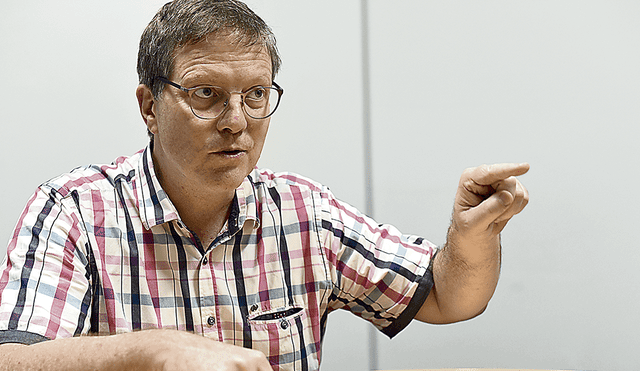

Michael Barry, the Chief Investment Officer at the prestigious Jesuit-sponsored Georgetown University in Washington, D.C., is illustrative of the new possibilities those conversations can open up.

Barry is indisputably a money man, using terms such as “concessionary returns” and “niche private equity” with the ease with which a serious baseball fan can talk about “OPS” and “wins against replacement.” Yet Barry also believes in the Church’s mission of trying to do good in the world, and he’s convinced it’s worth exploring ways to do that without sacrificing financial performance.

Georgetown just adopted a new investment policy, which establishes impact investing as one of four core priorities. Barry spoke with Crux in Rome during the impact investing conference, held at the city’s Crowne Plaza hotel.

Crux: What is impact investing, and what makes Georgetown interested in it?

Barry: Our understanding of impact investing, in the broadest strokes, is trying to find investment opportunities that not only deliver a financial return that’s commensurate with what we’re trying to achieve with our whole portfolio, but also a social impact, some sort of benefit that’s measurable to the broader society. It could be across a range of different areas, but the idea is to amplify the capital we have, putting it to work not just for our core mission – which is to support the work of the university, generating dollars for scholarships and research and so on – but also trying to create a broader sense of return to society writ large.

Give us an example of what an ‘impact investment’ looks like.

We’re relatively new to this space, so I don’t want to oversell what we’ve accomplished to date. We still have a lot to learn, which is the reason we’re here – to learn, and to build out our network. So far, we’ve primarily focused on two different areas, which are health care and renewable power. There are plenty of other areas people are exploring, including financial inclusion, education technology, and a host of other issues, but this is where we’ve started.

In renewable power, we’ve only made a handful of investments to date, and they’ve come in solar development. As endowment managers, we partner with other managers, so we’re essentially a manager of managers. We allocate our capital out to these firms, and then they go and make the direct investments themselves. We were looking around for a firm that could help us get involved in the solar space, and we found one that provides short-term funding for developers of utility-scale solar farms. A good example is a development company that’s putting up a 40 to 50 megawatts, maybe 100 megawatts, solar farm, and they need financial support to get through the last stages of development capital. Our manager provides that financial support through a private credit structure, essentially meaning loans.

These loans are typically structured to where you can earn about a 6 to 7 percent cash yield, and then maybe another 6 to 7 percent PIK, or payment-in-kind, which is essentially a payment at the back end. Usually, they would attach some small amount of warrants, maybe 2 to 3 to 5 percent warrants on equity. So, the total gross return you could look at in this particular case is probably on the order of 13 to 14 percent. When you net out manager fees to us, it might come down to about 9-11 percent range, with some upside cases from there and also some downside cases. That’s our case, which is about that 10 percent range.

Describe Georgetown’s new policy on impact investing.

All of it was kicked off by our Board of Directors, especially Paul Tagliabue who was the chair at the time. [Tagliabue is a former Commissioner of the National Football League.] Really, what kicked it off was a series of meetings with students who were interested in seeing the university divest from fossil fuels, and that helped inspire our Board of Directors to take a broader look at our investment policies.

Led by our board chair, we decided to redraft and expand our socially responsible investing policy. The four key tenets are:

- Alignment of our values and our investments, the sort of “thou shalt not” list.

- Integration of ‘Environmental Social and Governance’ concerns into our portfolio, trying to tilt it toward companies with stronger ESG practices.

- Engagement, such as voting our proxies and, when necessary, to get involved with companies.

- Impact investing, which was heavily debated as we crafted this policy. Rather than creating a mandate, the board and the committee that was formed to tackle this issue thought we could keep it as open as possible to weave impact investing into the overall portfolio.

One other thing we’re just recently tackling is the issue of diversity, which doesn’t get much coverage in the asset management world. From the allocators’ side, the question is what’s the range of diversity among the managers we employ? There’s not a lot of transparency about this topic, and we’re only starting to have conversations about it.

For example, in our portfolio roughly 80 percent of the capital is managed at the senior staff levels by men, only 20 percent by women.

Do you think that shapes investment decisions?

It most certainly does, and I think it could be shaped better if that percentage [of women] inched higher.

When you look at the percentage of senior staff at all of our investment firms who are minorities, that’s only at about 20 percent today. That number itself is probably a little bit misleading, because it includes groups such as Indian-Americans, so it doesn’t segregate out the numbers for African-Americans and Latino-Americans. The big problem is access to the financial services industry for people of color, and women as well.

We would want to expand the conversation, including by being a little bit public with our numbers. We hope that in addition to being the right thing to do, it can also lead to greater cognitive diversity across our investment firms, which ultimately leads to better decision-making processes and better returns.

Supporters say impact investing could be the last piece of the picture to achieve the UN Sustainable Development Goals, including ending global poverty, hunger, and lack of water. Do you think that’s an attractive vision, in which people will be willing to invest?

I think so, and we’re seeing a lot more uptake in the topic in the United States. Non-profit institutions with capital to invest in the U.S. are probably a good number of years behind what we see as the landscape here in Europe, but the conversation about impact investing and the SDGs is growing fast, since they’re sort of overlapping issues.

One of the things we’re trying to think about is that government support only goes so far, pure philanthropic support from foundations only goes so far, so impact investing might be able to play this role of fitting in the middle. That may especially be the case with what’s known as ‘concessionary investments,’ which might fill that missing middle part.

One of the things we’ve talked about at the conference is just how broad the spectrum is for impact investing. We’re probably all the way over on one side, which means full market rate and trying to achieve a level of return that’s commensurate with the rest of our investments. One of the providers characterized that as kind of an ‘A’ bucket, with A-1 (an already existing market) and A-2 (developing a new market). In both cases, they’re trying to achieve levels of return that are the same, if not even higher, than the rest of your private equity portfolio.

Then there’s a ‘B’ category, which is more the concessionary returns. Maybe you’re taking a lower return to achieve the impact, or a slightly higher risk in order to achieve the targeted return and the impact. It can also include simply preservation of capital, not expecting a return but simply wanting to recover your capital.

Those last two categories are wonderful spaces for foundations, for instance, where they can overlap with their PRIs, or program-related investments. For universities and endowments, we’re not going to occupy that middle zone, we’re going to focus our efforts on market-rate returns, this ‘A’ category.

The ‘C’ category would be straight grant-making, where there’s an expectation that there could be a loss but it’s not a pure donation, because there’s the idea of investment in some significant effort.

Let’s talk about that ‘A’ category. At the beginning, were you skeptical you actually can make money doing it?

That’s an important question especially coming from the U.S., where our mindset is much more focused on shareholder concerns, not necessarily on the stakeholder model of capitalism. We put shareholder returns first, and that permeates a lot of the thinking within the endowment community. When we first started engaging in, maybe we weren’t skeptical, but were a little bit curious and nervous over whether we could actually go about this in a way that would achieve success. We’re crawling, we’re getting there.

What we’ve discovered as we’ve gone down the route is that it’s essentially a little bit like niche private equity. It’s about opportunity sets, like the solar example I mentioned. It’s really just finding a pocket of supply and demand imbalance for capital. There happens to not be a lot of commercial banks willing to lend to these small-scale solar farms, and so we’re providing the capital where others aren’t, due to a whole variety of reasons why the other capital providers won’t, and we’re being compensated handsomely for that. In terms of the risks, we’re essentially capturing a very nice spread over the utility companies that are offering an extended power purchase agreement with these solar farms. It’s a fairly safe return from an investment-grade utility company.

In other words, that example is proof that you can both do good and make a decent return?

It’s anecdotal and a small sample set, but so far, as we’re crawling down the field, yes.

Do you think most people drawn to impact investing are going to want to be in that ‘A’ category?

I think most folks in the U.S., at least my peers at the other endowments as opposed to the foundations, are still under the assumption that impact investment equals concessionary returns. That’s an assumption based, I think, on really just not doing their homework and trying to figure out how to go find these niche opportunities that actually do deliver attractive financial returns.

It’s yet to be determined, but I think there is still a reticence in the community to engage in the homework. Most endowments say we’d rather not be handcuffed, just try to leave us alone. It’s an overlap in some ways for the divestment conversation that’s taking place at the moment in the US, primarily about fossil fuels. Most folks are probably in the mindset that the job of trying to generate returns is hard enough as it is, let’s not find more limits.

We’re trying to flip that around, saying we’re just trying to go out and find pockets of alpha opportunity that perhaps have been overlooked, and this is one more tool in our broad toolkit. That’s part of the reason why we don’t have a mandate or a limit in terms of capital, either a ceiling or a floor, in terms of the amount we can put into so-called impact investments. Today we’ve committed approximately $90 million to what we might describe as impact investments, through not all the managers in that category probably would self-describe that way, except for people involved in digital healthcare IT. Many would just look at their efforts and say they’re driving superior outcomes. When you start going down the rabbit hole of what counts as impact investment, you get into intentionality and it can be fuzzy.

What’s struck you about this conference?

One thing is just how broad a range of folks are here. There’s definitely a heavy connection to the Church, broadly and globally, but there are a lot of investment folks here managing large pools of capital. Some of the healthcare-oriented institutions in the U.S., such as Ascension Healthcare, are here.

It’s a very open conversation. I think people are really interested in seeing how others are pursuing this field, and I’ve met a lot of great folks.