There’s a growing trend in the investment community that advances shareholders’ beliefs — without compromising their returns.

Using a strategy known as “socially responsible investing,” investors direct capital towards companies that yield positive social change — and solid returns. Between 2012 and 2014, assets under socially responsible investing grew an astonishing 76 percent to $6.57 trillion in the United States.

This investment philosophy ought to appeal to Catholic investors looking to advance their faith by leveraging their assets. In fact, when Catholic investors align their financial interests with their beliefs and Church teachings, we call it “Catholic responsible investing,” or CRI. It offers investors an opportunity to grow their portfolios — and to live their faith through their investments.

Perhaps most importantly, this strategy can create profound societal change by improving how businesses operate.

There are many elements of CRI. One essential feature is Catholic investment screening. In essence, this means identifying companies that engage in practices or business lines that are contrary to Church teachings, and removing them from one’s list of potential investments.

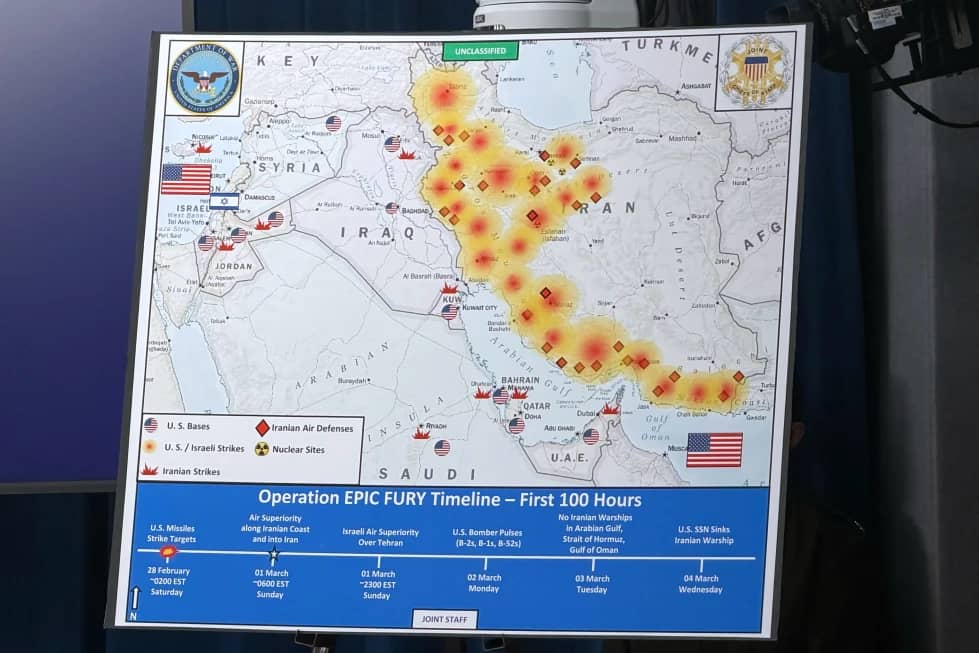

At Christian Brothers Investment Services, for example, we employ a variety of screens in our portfolios, including a “Violence” screen that precludes us from investing in some defense contractors. Additionally, a “Life Ethics” screen helps guard against companies that we believe don’t respect the sanctity of human life. And another screen precludes investment in companies that produce pornography.

The screens do rule out some investment opportunities. But research has shown that there is little to no performance hit from incorporating such screening into investment decisions. In fact, a recent paper from New Amsterdam Partners, a New York-based asset management firm, shows a positive link between high social impact ratings and competitive returns.

But CRI is more than avoiding investments in certain companies. Catholic investors can also use their influence to leverage positive social change. CRI encourages companies to adopt business practices that champion human rights, environmental stewardship, and treat their employees well.

Furthermore, it pays to champion the common good. The Domini 400 Social Index, which only lists companies that meet certain stringent social impact standards, averaged annual returns of 8.4 percent from 1990 to 2008. By comparison, the Standard & Poor’s 500 Index averaged just 7.8 percent.

In other words, Catholics can invest based in their beliefs without compromising on performance potential — and make a positive difference in the process.

Socially responsible investing is not a new or novel concept.

In fact, its history in America began with faith movements. In the middle of the 19th century, the Methodist Church and the Religious Society of Friends refused to invest in organizations that contributed to the slave trade and the tobacco industry. The first public investment fund to screen out groups based on immoral practices was established by a religious group in 1928.

This style of investing played a key role in ending apartheid in South Africa. In the late-1980s, investors screened $625 billion to stop investment in the region, helping force an end to the country’s segregation.

And increasingly, SRI investors are combining research-driven screening with “active ownership” of their portfolio companies. These active owners invest in firms across all industries, and then use their influence as shareholders to push for improvements in line with their beliefs. Since our founding, CBIS has used this strategy to further incorporate values into the marketplace.

In other words, how we invest can make a difference in the world, and Catholics can wield enormous economic influence over the companies in which we invest.

Today’s younger generation understands this too, presenting an opportunity for the Church to rekindle the spirit of the Catholic faith with a new generation. Seven out of 10 millennials are self-described social activists. Catholics can help bring to the market a new sense of responsibility for promoting and protecting the common good.

These young adults’ investment decisions are guided by their ethical and social beliefs to a much greater extent than previous generations. Four out of five purchase from companies whose values resemble their own. And three out of every four believe that corporations should address societal concerns. This age group, numbering 86 million, makes up the largest segment of the US population.

Catholic millennials will expect no less from their charities, schools, and organizations. They want to invest in accordance with their Catholic faith wherever possible. CRI makes this possible — and helps promote Church teaching to a whole new generation.

Francis G. Coleman is the executive vice president for CBIS and oversees its Catholic Responsible Investing team.