ROME — The Vatican is heading into a regular review of its efforts to fight money laundering amid a mysterious firing at its bank and ongoing questions about Pope Francis’s ability to reform the Holy See’s finances.

The Council of Europe’s Moneyval committee is expected to issue a progress report Wednesday on the Vatican’s compliance with international norms to fight money-laundering and terror financing, particularly at its bank.

A week before the Moneyval report, the Vatican abruptly fired the bank’s respected deputy manager, Giulio Mattietti, who had been instrumental in getting the Vatican its initial passing grade with Moneyval in 2012.

No reason was given. The bank, known as the Institute for Religious Works, has only issued a cryptic statement saying Mattietti left “after due consideration” and as part of “normal administration procedures.”

RELATED: Latest Vatican mystery raises more questions about pope’s financial reform

While unconnected, the firing followed the mysterious departure of the Vatican’s first-ever auditor general, Libero Milone, in June. The Vatican initially said Milone had resigned, albeit two years into a five-year term. Only after Milone claimed the Vatican made trumped-up charges against him did the Vatican accuse him of having hired an outside firm to spy on Vatican officials.

No replacement has been named.

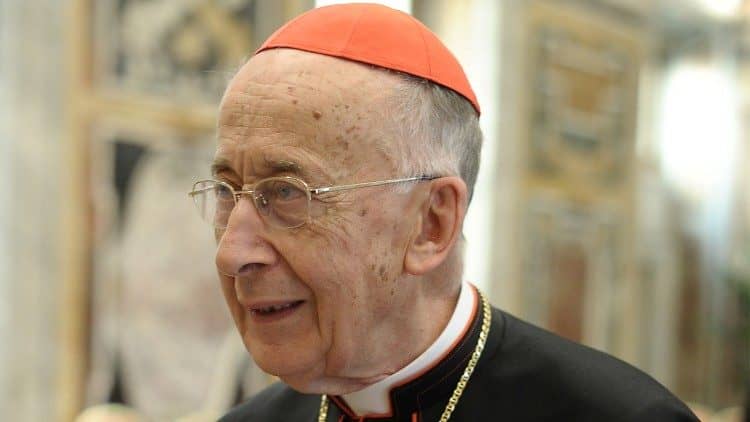

And in another blow to Francis’s financial reform plans, the Vatican’s finance minister, Cardinal George Pell, took a leave of absence in July to face historic sex abuse charges in his native Australia. Pell denies the allegations. But his Secretariat for the Economy — created by Francis in one of his first major efforts to streamline the Vatican’s finances — has been leaderless ever since.

The Vatican does have one positive note to show Moneyval: It recently put two former officials of the pope’s pediatric hospital on trial on embezzlement charges, precisely the type of prosecution Moneyval evaluators want to see as evidence of the Vatican’s enforcement of its own laws on financial transparency and accountability.

The former hospital president was convicted of lesser abuse of office charges and sentenced to a one-year suspended sentence; the former hospital treasurer was absolved.

The Vatican submitted to the Moneyval evaluation process after it signed onto the 2009 EU Monetary Convention and in a bid to shed its image as a financially shady tax haven whose bank has long been embroiled in scandal.

In the prior 2015 evaluation, Moneyval urged Vatican prosecutors to actually bring charges in some of the 25 money-laundering investigations they had opened.